I'm going to share somethings that not many people talk about, and contractors do not want you to know. By the end, you'll know why...

But let's start from the beginning…

You're considering getting some work done around your home. You need to hire a contractor.

Should You Get A Loan for Home Improvements?

Borrowing money to pay for somethings isn't recommend. A new watch or a luxury car probably isn't going to contribute much to your overall happiness. Those things also aren't likely to hold their value.

Your home on the other hand is a little bit different. Home improvements can serve a life improving function such as making the stairs accessibly by wheel chair or keeping the kids (primarily) isolated in a different section of the house. Your home is enjoyed by others from your kids that live with you to the grand children that visit occasionally. On top of that, home improvements do have residual value… they add value to your home, it's not just money wasted on ‘items'.

According to the Happiness Research Institute 73% of people who are happy with their home are also happy in general; which links to emotional, material, and personal condition.

Some home improvements like air conditioning, and electrical, could have a direct effect on your health and comfort. Others such as solar may have long term economic advantages (ie. you buy a new solar system, get a tax credit, eliminate your electric bill, and then get a payment for electricity contributed to the grid).

Considering that, home improvements are possibly the smartest purchases to finance.

In the process of shopping for a contractor for your project you'll certainly find contractors that offer their ‘in-house' financing.

Contractors Will Have Appealing Financing Offers

Some contractors advertise their financing offers on their website, but even if not, they will typically ask if you're thinking about financing. Sometimes this detail is even covered before an appointment is scheduled.

What you'll notice is that they almost never offer standard payment and interest rate plans.

Instead you'll see catchy financing options like '12 months same as cash', or '72 months no interest'.

They sound great… who wouldn't want to have ‘free money for 72 months'?

Reality check… nothing is free, including the offer from a contractor that just wants to earn your business.

Now before we go any further, I want to clarify that contractors offering financing are not bad… they're simply doing their job and providing what the market wants. Homeowners respond to these financing offers and to be competitive, contractors have to offer them and lose sales.

Fortunately you've found my blog to help you make an economically savvy decision.

The Secret Fees Behind Contractor Financing

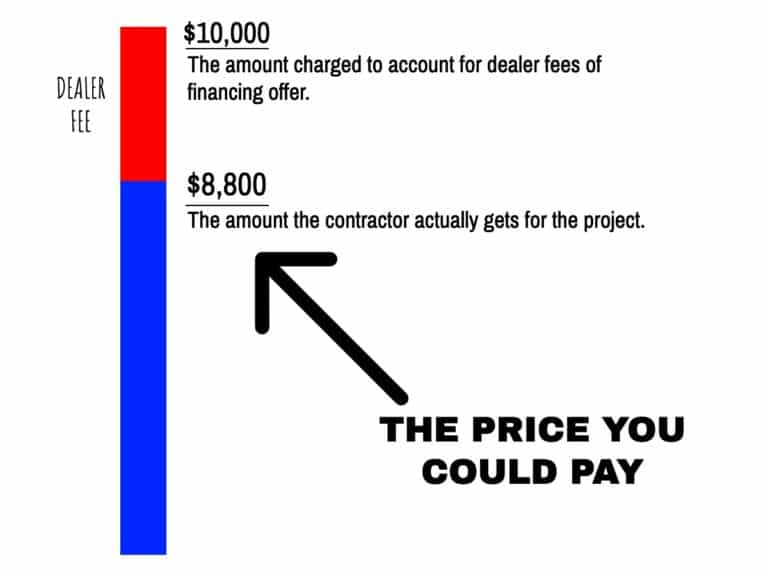

Let's say a contractor is charging you $10,000 for a home improvement project. On the loan application, you see that is for precisely $10,000. It all seems straight forward… where's the secret fees?

The contractor is paying them, and he is charging you for them.

Here's the real deal, the part contractors and their financing partners don't want you to know… contractors have to pay a fee to offer the financing.

So in the common and realistic financing offer of '12 months no interest, no payments', you as the consumer appear to be getting ‘free money' for 12 months. You do the deal now, and pay $10,000 in 12 months. But to offer this form of financing plan, the lending bank charges the contractor a fee to offer this. This is called the ‘dealer fee'. In my experience the common fee on on this type of plan would be 12%.

Now of course the home improvement company isn't just ‘eating' the 12%; they've strategically increased the price to accommodate that fee they will have to pay the lending bank. Really you're paying $10,000 for which the contractor will get $8,800.

These dealer fees range based on the financing offered. The sweeter the offer, the higher fee. The highest dealer fees I've seen have been around 40% for '72 month no interest plans'.

Once understanding these fees are built into your price, don't things seems a little dicey. In the last section I explain how to get the best deal while still financing the project.

Other Reasons Not To Go With Contractor Financing Offers For Home Improvement Loans

Paying inflated prices to account for the dealer fees isn't the only reason to avoid contractor financing offers. Let's take a look at some others.

You're In The Drivers Seat Of The Project

When you're talking to a contractor and dealing with a high value, and complex home improvement project, do you really want to be dealing with mucky numbers?

Of course not! You need your conversations with a contractor to be focused on the ultimate outcome of the project and the bottom-line number it will cost you.

Many Companies That Offer Financing Through Contractors Have Poor Customer Service

Just do this, ask your contractor which lender they work with (or just look at your application documents), and then type that name + reviews into a Google.

No matter which company they work with, you'll notice a trend of bad reviews. 1 star reviews are abound for things like not properly disclosing the pay off date, to not offering a an online log-in or auto-draft… all things customer-centric modern lenders should have!

How To Get The Best Deal

Now let's go into how to get the best deal.

Cash is king!

Fortunately when you use a 3rd party lender, you can pay cash. With 3rd party lenders the as the funds are released directly to you — then you pay the contractor in cash! Our recommend 3rd party lenders with low rates that you can apply for are listed below.

Let's run through a scenario. We'll use the same numbers from above…

A $10,000 project, and the contractor offers a '12 months no interest, no payment' plan. Knowing that you can get financing elsewhere and (now knowing) that there is a fee built into the price you pay, you negotiate a cash discount and pay $8,800 for the project.

Now the concept is really simple;

Contractors pay fees for the home improvement loans that they offer consumers, so they inflate their prices, therefore it is better to secure financing elsewhere and negotiate a cash discount.

Let me address a couple questions and give you some tips to get the best deal!

How much discount can I negotiate?

This really depends on the level of ‘sweetness' the financing offers. As I describe above some of the offers may go as high as 40% (they may be more that I do not know about). Typically though, contractors budget 10-20% for financing offers. In my experience it is very rare to see them going above 20%. In the expert tip below I explain how to figure out the best way to find where the threshold is.

Does every contractor offer a cash discount?

Simply put no. Contractors that offer financing plans, can do a cash discount because they've built the financing fee into their price. Ethical contractors that don't offer financing have nothing built into their price to deduct (unethical operations may deduct to avoid taxes, but anyone that will cheat Uncle Sam, will cheat you).

Recommended Home Improvement Loan Lenders

Now you know how the system works. These are some recommended lenders based on my research.

We have no relationship with them and DO NOT receive any compensation from them, they are simple well rated lenders, with good rates published.

All of them are 100% online, go ahead and apply now and see who gives you the best rate!